The Debit and Credit in Accounting

From the worked example, we have learned that the accounting equation and the balance sheet remain balanced after recording each transaction no matter how many transactions are entered each time. However, in the real world, we don’t enter transactions in the book of accounts in equation form or directly in the balance sheet. Instead, we initially record transactions in daybooks and then post them into Ledgers/ accounts. Ledgers usually have a specific format, as provided above.

If we look closely the above format is in T-shape therefore ledgers are also called T-accounts.

The debit and credit in Accounting

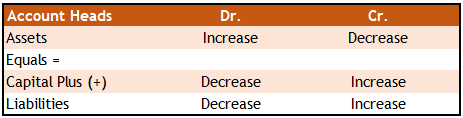

We already have learned that transactions increase or decrease assets, liabilities, or capital. While recording these transactions into Asset, capital, and liability accounts, the following Debit and credit rules of bookkeeping are observed:

- If Assets are increased the amount is entered on the debit side of the asset account, hence called Debit Entry. On contrary, if a transaction results in a decrease in Assets (e.g. asset is sold), then the amount of transaction is entered on the credit side of the asset account and called credit entry.

- On the other hand, if Liabilities and Capital is increased, the amount of increase in Credited in the corresponding account and vice versa.

The above rules can be better demonstrated in the below tabular form:

We know that capital is the claim by the owner over the assets of the business. The capital investment include the initial investment by the owner and the amount of accumulated profit not yet withdrawn from the business yet. Hence we can easily say that the profit and income which may result into increase in capital shall be credited, whereas losses, expenses and drawing that results in decrease in capital shall be debited.

Note: There are many explanations why the increase in assets is debt and the decrease in credit. However, at this stage, it is recommended not to go for the reason behind these rules and simply memorize debit and credit rules. Eventually, as you progress, and once you gained a sound grip over these rules, you will learn the reasons behind doing debit and credits.

An easy way to memorize the debit and credit rule is, to remember DEAL (Drawing, Expenses, Assets, and Losses) for Debit and CLIP (Capital, Liabilities, Income, and Profit) for Credit.

The rule of debit and credit in accounting for liabilities and capital are the same, but they are exactly the opposite of assets.

Before you read any further, better go through a worked-out example so you can understand how entries are recorded into books of accounts using these rules