Example of Accounting Equation

Now let’s practice with an example of an accounting equation and see how proper classification of transactions keeps the accounting equation balanced. Further how transactions are recorded in journals and Ledgers/ accounts.

Example of Accounting Equation

In May 20X7, Mr. James started a business and made some transactions;

| 1 May 20X7 | On 1 May 20X7, James started in business and deposited $60,000 into a bank account opened specially for the business |

| 3 May 20X7 | On 3 May 20X7, James buys a small shop for $32,000, paying by cheque |

| The effect of this transaction is that the cash at the bank is decreased and the new asset, building, is added | |

| 6 May 20X7 | On 6 May 20X7, James buys some goods for $7,000 from David and agrees to pay for them sometime within the next two weeks |

| The effect of this is that a new asset, stock of goods, is acquired, and liability for the goods is created. A person to whom money is owed for goods is known in accounting language as a creditor | |

| 10 May 20X7 | On 10 May 20X7, goods that cost $600 were sold to Wilson for the same amount, the money to be paid later |

| The effect is a reduction in the stock of goods and the creation of a new asset. A person who owes the business money is known in accounting language as a debtor | |

| 13 May 20X7 | On 13 May 20X7, goods that cost $400 were sold to Sarah for the same amount |

| Sarah paid for them immediately by cheque Here one asset, stock of goods, is reduced, while another asset, cash at the bank, is increased | |

| 15 May 20X7 | On 15 May 20X7, James pays a cheque for $3,000 to Clearance in part payment of the amount owing |

| The asset of cash at the bank is therefore reduced, and the liability to the creditor is also reduced | |

| 31 May 20X7 | On 31 May 20X7, Wilson, who owed James $600, makes a part payment of $200 by cheque |

| The effect is to reduce one asset, debtor, and to increase another asset, cash at the bank |

Assessing Impact of Each Transaction

The above example is well explained in the below table along with its impact on assets, capital, and liabilities.

| Date | Transaction | Assets | = Capital | + Liabilities |

|---|---|---|---|---|

| 1 May 20X7 | Owner pays capital into the bank | ⇑ Increase asset (Bank) $ 60,000 | ⇑ Increase capital $60,000 | No effect |

| 3 May 20X7 | Buys Small Shop by Cheque | ⇑ Increase asset (Shop) $32,000 ⇓ Decrease asset (Bank) ($ 32,000) | No effect | No effect |

| 6 May 20X7 | Buy goods on credit | ⇑ Increase asset (Goods) $ 7,000 | No effect | ⇑ Increase liability (Creditors) $ 7,000 |

| 10 May 20X7 | Sale of goods for credit | ⇑ Increase asset (Debtor) $600 ⇓ Decrease asset (Goods) ($600) | No effect | No effect |

| 13 May 20X7 | Sale of goods for Cheque | ⇑ Increase asset (Bank) $400 ⇓ Decrease asset (Goods) ($400) | No effect | No effect |

| 15 May 20X7 | Paid back to the creditor. | ⇓ Decrease asset (Bank) $3,000 | No effect | ⇓ Decrease liability (Creditor) $3,000 |

| 31 May 20X7 | Debtor paid back | ⇑ Increase asset (Bank) $400 ⇓ Decrease asset (Debtor) ($400) | No effect | No effect |

From the above table, it can be seen that every transaction has an equal effect on both sides. This also reflects that the position of the equation remains balanced after every transaction.

Elaboration with Figures

The below table further elaborates this fact as follows:

| Date | Transaction | Assets | =Capital + Liabilities |

|---|---|---|---|

| 1 May 20X7 | Owner pays capital into the bank | Bank =$60,000 | Capital =$60,000 |

| 3 May 20X7 | Buy Small Shop by Cheque | Bank (60,000-32,000) =$28,000 Shop =$32,000 Total Assets =$60,000 | Capital =$60,000 Liabilities = 0 Total Capital + Liabilities =$60,000 |

| 6 May 20X7 | Buy goods on credit | Bank =$28,000 Shop =$32,000 Stock =$ 7,000 Total Assets =$67,000 | Capital =$60,000 Liabilities =$ 7,000 Total Capital + Liabilities =$67,000 |

| 10 May 20X7 | Sale of goods for credit | Bank =$28,000 Shop =$32,000 Stock (7,000-600) =$ 6,400 Debtors =$ 600 Total Assets =$67,000 | Capital =$60,000 Liabilities =$ 7,000 Total Capital + Liabilities =$67,000 |

| 13 May 20X7 | Sale of goods for Cheque | Bank (28,000+400) =$28,400 Shop =$32,000 Stock (6,400-400) =$ 6,000 Debtors =$ 600 Total Assets =$67,000 | Capital =$60,000 Liabilities =$ 7,000 Total Capital + Liabilities=$67,000 |

| 15 May 20X7 | Creditor paid back. | Bank (28,400-3,000) =$25,400 Shop =$32,000 Stock =$ 6,000 Debtors =$ 600 Total Assets =$64,000 | Capital =$60,000 Liabilities (7,000-3,000) =$ 4,000 Total Capital + Liabilities =$64,000 |

| 31 May 20X7 | Debtor paid back | Bank (25,400+400) =$25,800 Shop =$32,000 Stock =$ 6,000 Debtors (600-400) =$ 200 Total Assets =$64,000 | Capital =$60,000 Liabilities (7,000-3,000) =$ 4,000 Total Capital + Liabilities =$64,000 |

It can be seen that every transaction has affected two things. Sometimes it has changed two assets by reducing one and increasing the other. In other cases, the effect has been different. However, in each case, except for the first day (when the business owner started injecting some cash), no part of the equation was changed and the balance between the two sides was maintained. The accounting equation has proved true by example, and always will be. This representation is also called a balance sheet.

There may be other instances like when the owner withdraws resources from the business for his use. And where the owner personally pays for business expenses.

Dual Effect of Each Transaction

A summary of the effect upon assets, liabilities, and capital of each transaction you’ve been introduced to so far, is shown below:

| Transaction | 1st Effect | 2nd Effect |

| (1) Owner pays capital into the bank | ⇑ Increase asset (Bank) | ⇑ Increase capital |

| (2) Buy goods by cheque | ⇓ Decrease asset (Bank) | ⇑ Increase asset (Stock of goods) |

| (3) Buy goods on credit | ⇑ Increase asset (Stock of goods) | ⇑ Increase liability (Creditors) |

| (4) Sale of goods on credit | ⇓ Decrease asset (Stock of goods) | ⇑ Increase asset (Debtors) |

| (5) Sale of goods for cash (cheque) | ⇓ Decrease asset (Stock of goods) | ⇑ Increase asset (Bank) |

| (6) Pay creditor | ⇓ Decrease asset (Bank) | ⇓ Decrease liability (Creditor) |

| (7) Debtor pays money owing by cheque | ⇑ Increase asset (Bank) | ⇓ Decrease asset (Debtors) |

| (8) Owner takes money out of the business bank account for own use | ⇓ Decrease asset (Bank) | ⇓ Decrease capital |

| (9) Owner pays creditor from private money outside the firm | ⇓ Decrease liability (Creditor) | ⇑ Increase capital |

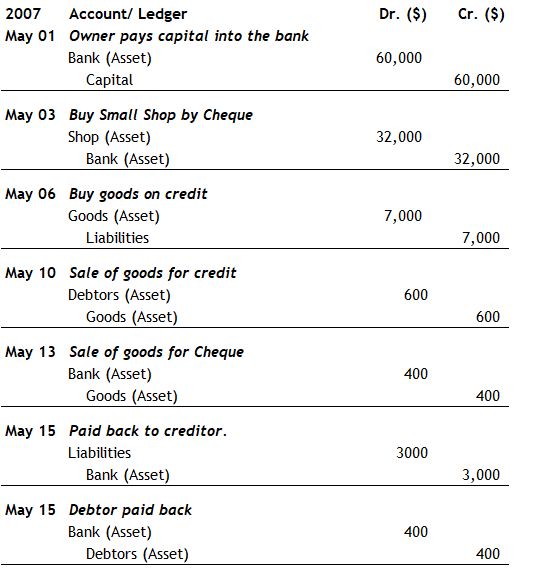

Journalising

Using Debit and Credit rules of Bookkeeping let’s make Journal Entries of transactions provided in the above-Worked Example.

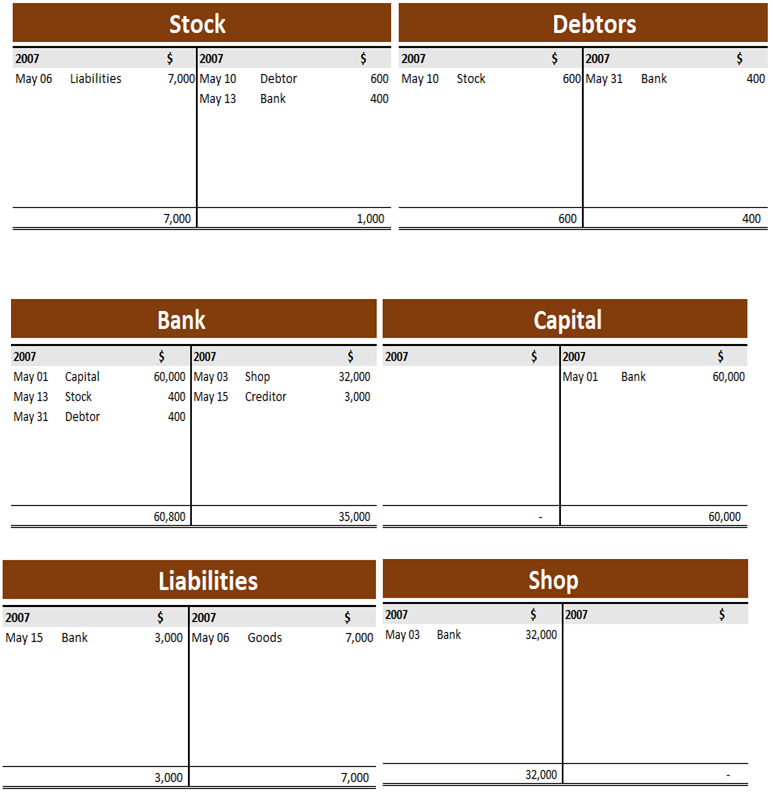

Posting

Now based on the Journal entries provided above, we can post these into relevant ledgers/ accounts.