Double Entry for Goods and Purchase Account

Double Entry for Goods/ Purchase Account

The inventory/ Goods bought with the intention to resell are recorded as expenses in the Purchase Account instead of any asset account.

Generally, term goods include all types of property such as land, building, machinery, furniture, textiles, etc. However, in accounting, its meaning is limited to items that a trader purchased with the intention of re-selling them. For example, if a businessman has purchased a car, it would be good/ stock for him if he sells cars in his ordinary business but if he deals in another business (e.g. clothes and accessories), then the car is an asset for that business.

According to the matching concept, costs consumed in the period to earn the revenue shall be charged in that period as an expense, thus for a business involved in trading goods, only cost of those goods to be charged which were sold during the period and the cost of the goods remained unsold at the end of the period shall be carried forward as assets.

In earlier examples we solved, goods were sold at the price at which these were purchased. Of course, this is very unusual. Generally, goods are sold above their cost prices, thus the difference between cost and sales price results in earning profit. This actual practice of purchasing goods at a lower cost and selling it at higher prices to earn profits makes it difficult to record all the transactions of goods in a single account.

The debit side of the goods account will be recorded at purchase cost. Whereas at the time of sales, transactions will be recorded in the credit side of the goods account by the sales price of the goods. This sales price consists of both purchase cost and profit elements while the difference between the two sides of the goods accounts at any point shall only represent the cost of goods that are not yet sold. Therefore, the goods (asset) account will not reflect the actual position of stock unsold at the period end. This problem is further elaborated by an example below;

Mr. A started a business, selling printers and during the month of May, 20X9, he incurred the following transactions;

- May 01, 20X9, he purchased 10 printers @ $1,000/- each.

- During the month he sold 8 printers @ $ 1,200/- each

- At the end of the month, 02 printers remained unsold.

If the above-stated transaction are recorded in the Goods (asset) account;

At the end of May 2019, the cost of unsold computers is $2,000 ($1,000 X (10-8)), whereas the ledger account shows a debit balance of $ 400. In fact, this is misleading and not the actual status of unsold computers at the end of each period.

Sub-Division of Goods Accounts

Practically trading of goods involves the purchase, sales, purchase return, and sales return functions. To uphold requirements of matching concept and to reflect the actual status of stock at the end of each period instead of maintaining stock/ goods account, record day to day transactions of goods in the sales, sales return, purchase return, and purchase accounts;

- Purchase Account: It is open to record cash and credit purchases. A purchase account is an expense account by its nature.

- Sales Account: This account is opened for goods sold on cash and credit. By nature, a sales account is treated as an income account.

- Purchase Returns Account or Return Outward Account: This account is opened to record goods returned to suppliers. This account is treated as a reversal of expense (and income) account.

- Sales Returns Account or Return Inward Account: Sales return account by its nature is a reversal of income (an expense) account.

Double entries for Goods/ Stock

Let’s look at this worked-out example to see how the stock transactions are recorded in books of accounts.

|

20X9 | |

| July 1 | Bought goods on the credit of $520 from Mr. Johan. |

|

July 2 | Bought goods on the credit of $470 from A Mike & Son. |

|

July 5 |

Sold goods on credit to Mr. Bonson for $90. |

|

July 6 |

Sold goods on credit to Ms. Victoria for $95. |

|

July 10 |

Returned goods $35 to Mr. Johan. |

|

July 11 |

Goods sold for cash $200. |

|

July 12 |

Goods bought for cash $250. |

|

July 19 | Ms. Victoria returned $18 for goods. |

|

July 21 |

Goods sold for cash $ 185. |

|

July 23 |

Paid cash to Mr. John $ 200 |

|

July 28 |

Mr. Bonson paid the amount owing by him $ 70 in cash |

|

July 31 |

Bought goods on credit $ 140 from A Mike & Son |

Let us know if you have anything to ask?

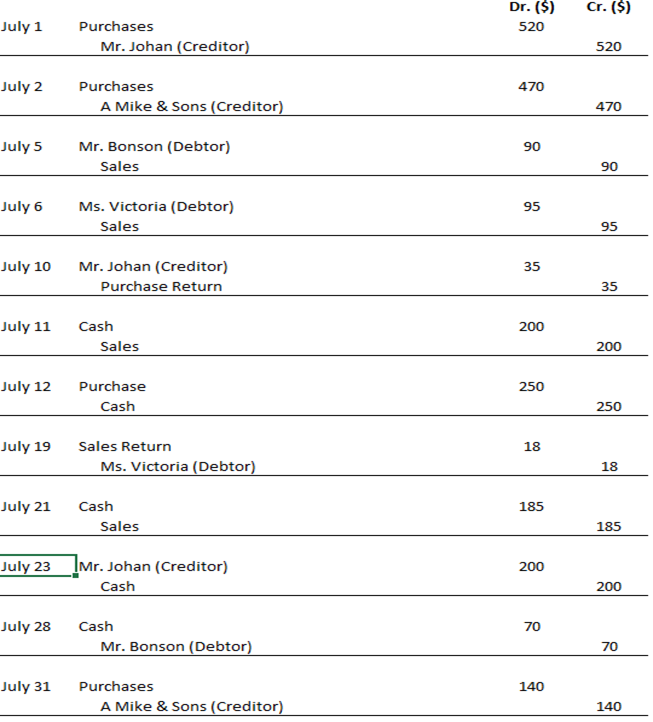

The Journal Entries of the above-given example are as below:

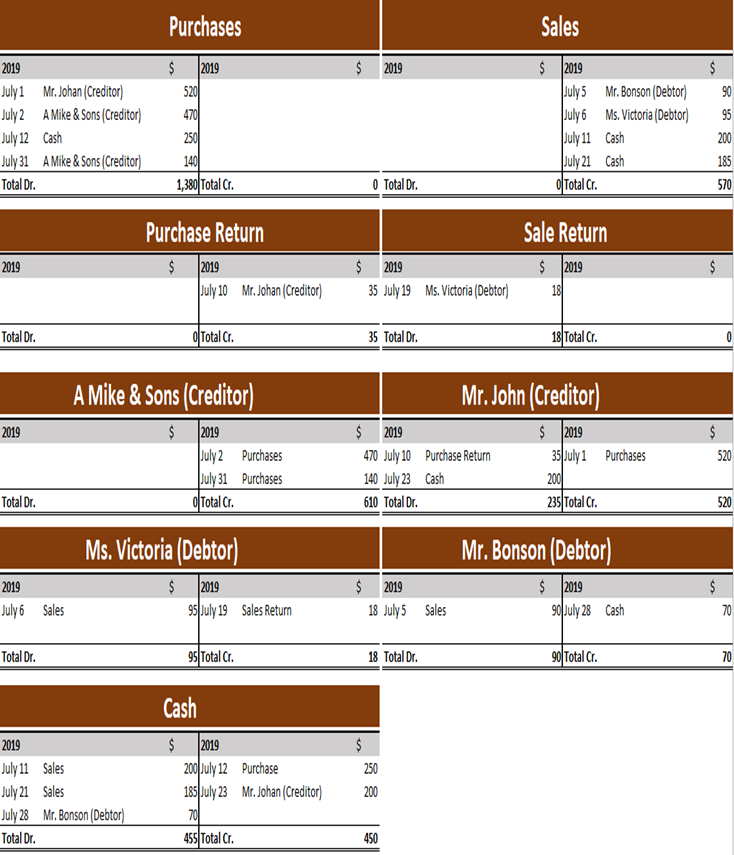

Above Journal Entries will be posted into accounts.

Let us know if you have anything to ask?

Special Meaning of Sales and Purchases

You need to remember that ‘sales’ and ‘purchases’ have a special meaning in accounts when compared to the common use of language.

Purchasing in accounting means purchasing the goods that the business buys with the intention of re-selling instead of using them for other business activities. Of course, sometimes the nature of business activities changes, however, this is the resale factor that is important to consider. For a business that trades in computers, buying a computer is recorded in the “purchases” account, on the other hand, if this business buys a computer, particularly for the purpose, that this computer will be used for record-keeping and not for trading, then only this computer will be treated as an Asset.

Similarly, the sale means the sale of goods in which the business normally deals and which were purchased with the original intention of resale. The Account ‘sale’ should never be used in the possession of other goods, such as vans or buildings that have been purchased to use in ordinary business activities and not for resale. These are very important differentiation to be considered while recording transactions as if we don’t follow these rules while recording purchases and sales, it will be nearly impossible to identify at the end of the accounting period which items shall be treated as stock and which items as Assets.